Urbanisation has increased the interest in buying a house. House hunting comes with making many decisions and should not be done in a hurry. However, finally moving into one’s dream house comes with a sense of satisfaction and fulfilment of being free from the limitations that come with living in a rental apartment.

One cannot err in making adequate research about the area, the structure and the price. Asking the right questions and identifying potential issues about the property would go a long way in making informed decisions.

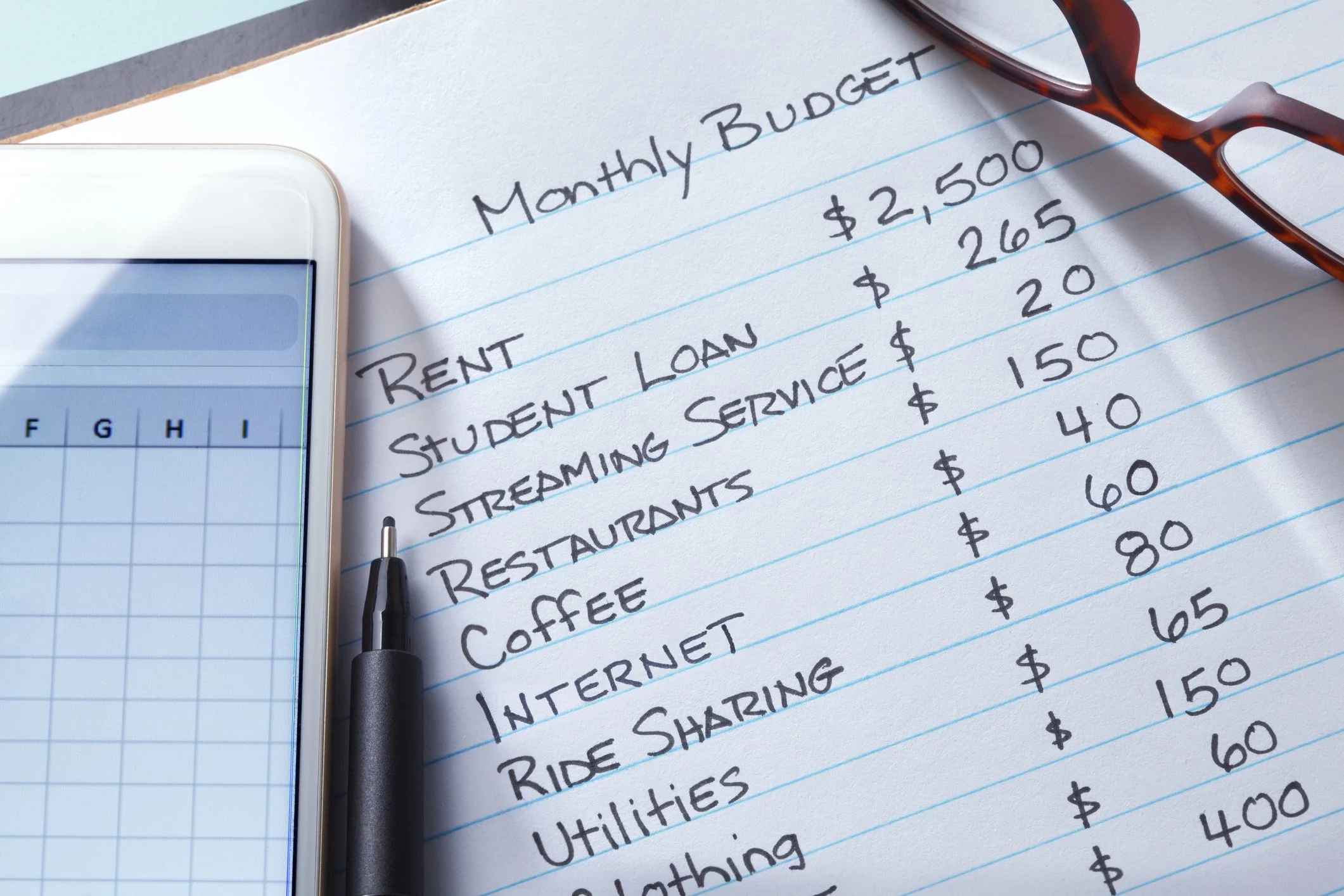

Understand your debt-income ratio

Affordability is relative. One needs to understand one’s debt-to-income ratio. Reyna Gobel of Investopedia stated that the debt-to-income ratio “is used to determine if the borrower can make their payments each month” after all the other debts have been paid. This ensures that the homeowner can spread the payment of the house, after the down payment, for a particular number of months or years as agreed by the realtor or seller.

Finding a real estate agent

What a real and trusted estate agent is to a house buyer is what a lifeguard is to an inexperienced swimmer. Although some people might be hesitant to use a realtor because they believe there will be “additional cost” that comes with their services, one needs to bear in mind that the seller also pays the commission.

Research the neighbourhood

Every neighbourhood has a definite character and what it is known for. Every genuine realtor has such information. Also, hearing from potential neighbours, other fact-based databases provided by the government detailing the types of criminal activity in the area as well as information from one’s real estate agent could provide direction on what one needed to know about the area.

Consider your lifestyle needs

Planning for the future is a crucial decision to consider when buying a house. These plans would determine if the preferred house would still be one’s favourite in the near future. For example, some neighbourhoods that are strictly for residential purposes would not favour a potential homeowner who would like to convert a space outside the apartment to a mini office or depot.

Think about commitment

After paying the agreed amount as a down payment, paying up the bi-weekly or monthly payments might be a challenge one must be strategic about. Gobel noted, “Before you practise making mortgage payments, give yourself a little financial elbowroom by subtracting the cost of your most expensive hobby or activity from the payment you calculated. If the balance isn’t enough to buy the home of your dreams, you may have to cut back on your fun and games—or start thinking of a less expensive house as your dream home.”

Age of the house

It is important for a potential home buyer to have a preference for the type of home they want. For example, one can prefer older houses or be interested only in newly built houses. Once this decision is made, Gloria Russell, an author with Homeia.com, advised one to be on the lookout for building codes of how houses were built at a particular time.

Do you plan to stay put?

Planning to stay in the long run apart from affordability is another factor to consider when buying a house. This, however, can largely depend on one’s job and profession. Nonetheless, Gobel advised, “If you can’t decide what city or town you are going to live in and what your five-year plan is, it may not be the right time to buy a home. If you want to buy a home without a five-year plan, purchase one that is priced much lower than the maximum you can afford. You’ll have to be able to afford to take a hit if you have to sell it quickly. Another exception: If you work for a company that buys the houses of relocated employees—one name for this is a guaranteed buyout option.”

Location

The location of one’s potential house further determines the accessibility to one’s place of work, children’s school, grocery store, bank and other to-go places.

Size

This includes the size of the property, building design, number of rooms and available appliances. One must also consider the available number of bedrooms and if there are options of remodelling or adding on to the property.

Negotiate the contract

Erb emphasised that “a house purchase involves a contract. When you’re buying a house, there are papers to sign. And more papers to sign. Many of those papers – which are actually contracts – look like “standard” home buying contracts with no room for negotiation. That isn’t true. Contracts are meant to be negotiated. You don’t have to sign a standard agreement. If you want more time to review your inspection, or want to make a purchase subject to mortgage approval, you can make that part of the deal. That’s where a savvy realtor can help.”